One tree

One tree One life

It is forecast that the global insurance market will grow by about one trillion U.S. dollars between 2024 and 2029, reaching almost $10 trillion. – (Source: Statista)

Aren’t these numbers amazing?

This growth brings along with it customer expectations as well. Customers now need to be able to access their insurance services through an application or software on their phones. They expect the process of checking policies, filing claims, and making payments to take a few taps using their mobile phones.

Insurance companies know that insurance mobile app development isn’t a luxury but rather a necessity in this day and age. Such applications assist insurers in establishing communications with their clients, increasing the rate of performance, and delivering specific services. They also facilitate the process of understanding customers’ needs and risks and enable one to come up with better solutions.

In this guide, we’ll walk you through the basics of building an insurance mobile app. We’ll provide simple and practical advice on everything from starting to creating an app, from defining the key features to the possible obstacles that might come your way. Let’s start by understanding the overview of the insurance mobile app and its key features.

Integrating mobile applications in the insurance industry is reshaping how insurance companies operate and engage with customers. Insurance app development is at the core of this transformation. It helps companies to provide their customers with better services. Here are ten insightful statistics highlighting this transformation:

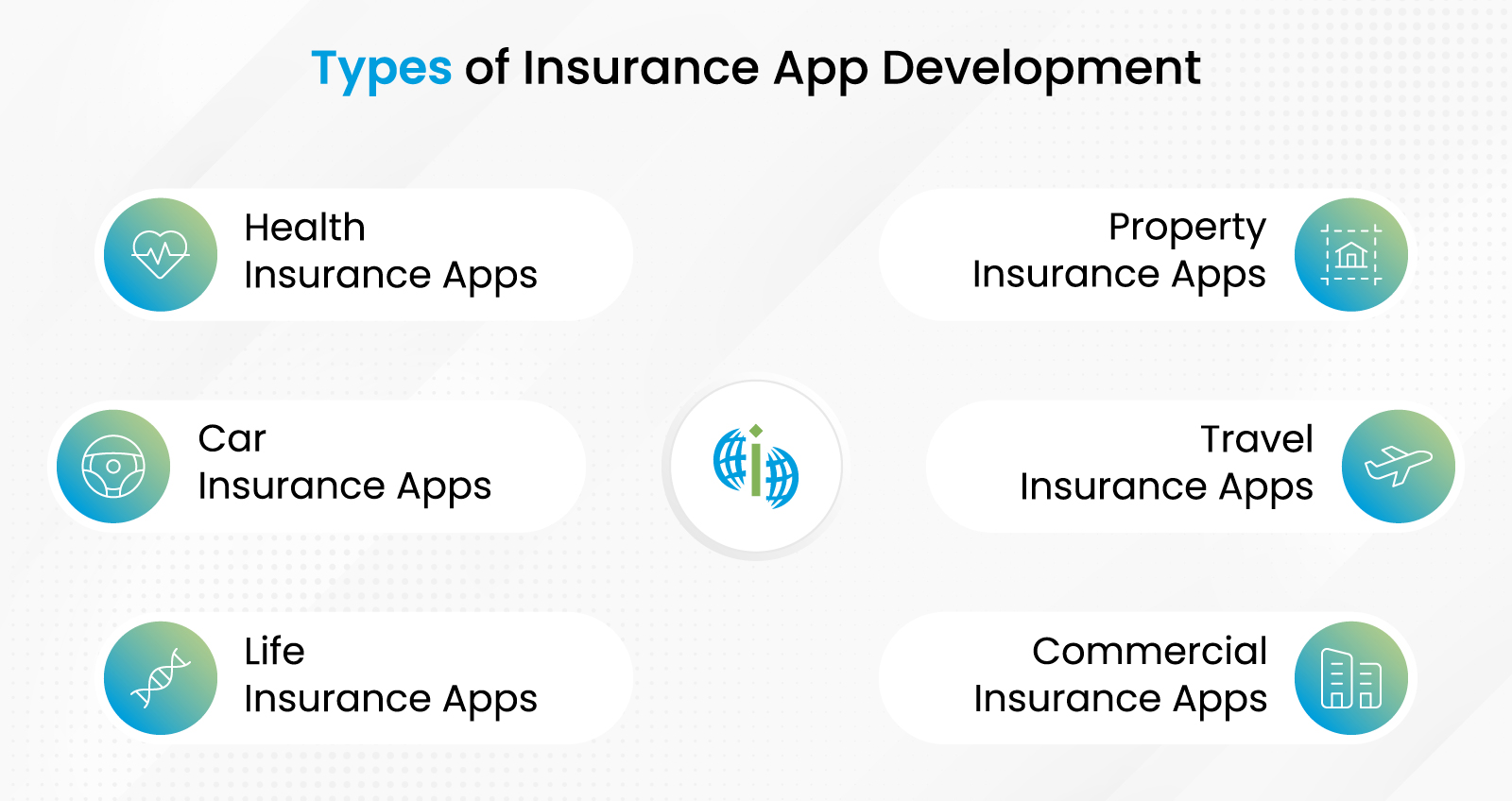

People should know that not every app is the same. They are all unique and created with different functions to meet certain requirements. Let me explain the different types of insurance mobile app development and what these apps are used for.

Think of these as your all-in-one health assistant. For those basic requirements such as confirming your coverage, submitting a claim after seeing a healthcare provider, or scheduling an appointment? It’s all possible here. Some even link directly to fitness bands that can help you maintain fitness levels and get rewarded!

It can be fun and useful to have an application that allows not only filing claims after an accident but also rewards safe driving behavior with lower premiums. For instance, if you are in the middle of the road and need help, you can get roadside assistance without having to wait. Handy, right?

These particular apps are your best friends for keeping those long-term plans in check. Regardless of whether you want to check on the status of your policy, make premium payments, or prepare for your financial future, it is possible to do so by using life insurance apps.

A Property insurance app, or a home insurance app, plays a major role in protecting your biggest asset, your home. These applications ensure that details of the property are uploaded and, more crucially, take care of all the claims in case of damages or disasters.

Suppose you are on a trip, something goes wrong, or you need urgent medical attention. With a travel insurance app, you can access help, check coverage, and submit a claim—all with just a few taps.

For business owners, commercial insurance apps are a blessing. It allows you to administer policies that secure your tangible and intangible company assets, your workforce, or business processes while focusing on business and the company’s day-to-day operations without the burden of paperwork.

Typically, insurance mobile apps allow citizens to transact their insurance at their convenience, time, and place. These apps allow consumers to access their policies, pay premiums, report losses, and seek assistance as quickly as possible. Insurance companies assist in enhancing services, reaching customers, and making the right decisions with data.

They make insurance easy, quick, and accessible all through an app that consolidates all the processes for all the users. For an insurance company to have a mobile application, it has to offer what will help manage the insurance conveniently. Here are some key features every app should include:

Easy Sign-Up and Profile Management

Nobody appreciates when issues are as complex as they are at the beginning. Any good app should allow users to sign up for accounts easily and keep all their details in one place.

Policy Management Made Simple

Do you need to view your policy information or get a new policy? An app should help you do this to a T so you always feel like you are the one deciding.

Quick and Hassle-Free Claims

Filing a claim should not be a bore. A great insurance claims management app allows users to upload documents and monitor the project’s progress while receiving current status reports.

Smooth Payment Options

Forget late payments! The app should provide friendly reminders and safe, convenient methods of paying for premiums.

Help When You Need It

Whether it’s a live chat or a helpful FAQ section, the app should be your go-to support system anytime.

A Place for Your Documents

There is no need to rummage through papers and documents. All your policy documents should be safely stored and also easily accessible through the app.

Timely Notifications

Stay updated with alerts about payment due dates, policy renewals, or even exclusive offers—right when you need them.

Extra Tools and Integrations

How about connecting with health trackers or accident reporting tools? These extras make the app even more valuable.

Transforming Health Insurance with Data-driven Analytics – Check Out Our Case Study Here.

Insurance mobile app development is important as it is beneficial to both the customers and the insurance companies in their respective endeavours. In today’s world, where digital transformation in insurance is reshaping the industry, customers seek ease and convenience, and mobile apps address these needs effectively. From easier administration of policies to easy access to claims and payments, these applications offer a boost to customer satisfaction.

For insurance providers, insurance app development can be useful decision as it lead to improved efficiency, lower expenditure and enhanced customer relations. Let’s dive into the key benefits of developing life insurance apps for your business.

24/7 Accessibility

With the help of insurance apps, the customer has the ability to access their policy and general data at his or her convenience. This implies that customers do not have to wait for business hours to make their claims or seek help.

Easy Claims Filing

In this case, use of an app means filing claims can be done with a lot more ease and within shorter time. Some of the benefits may include submitting documents, monitoring the status of a claim, and receiving information without contacting the company or visiting its offices.

Simplified Payments

The usefulness of insurance apps is also fostered by the fact that users can be able to make payments from within the applications in regard to various premiums and policy transactions. No more lengthy forms or longer waiting times.

Instant Support

Regardless of whether an application offers live chat, a help center, or an AI support system, it allows customers to get solutions to their questions or problems very quickly, thus improving their experience.

Better Customer Engagement

Apps allow customers to receive notifications or alerts, which can help them know about any change in policies, payment due, or possibly claims. This can enable the positive flow of information and facet the issue of lack of trust.

Operational Efficiency

The insurance companies may also derive some benefits from the mobile app in that it leads to less paperwork and internal manual jobs with minimized mistakes thus creating more revenue-saving and high efficiency.

Increased Customer Loyalty

An effective and convenient application creates customer trust and confidence that in turn contributes to repeated business and thus long-term patronage.

Reduced Operational Costs

The App helps to cut down expenses linked to labour and administration by performing complicated tasks such as claim processing, payments and customer service.

Better Data Collection

Apps allow insurers to collect valuable user data, which can be analyzed to improve services, create better policies, and deliver more accurate risk assessments.

Developing an insurance mobile app could seem like a huge project, but when the project is segmented, then it’s easier. The thing is to concentrate on the objectives and move accordingly; it may seem simplistic, but it is actually effective. Let’s go through the process in a way that’s easy to understand:

Understand What You Want to Achieve

First of all, one must try” to answer the following question”, ‘What this app has to perform at’. I wonder if it is about enhancing the customers’ ability to deal with their policies. Or are you concerned with optimization of claims and payments? Developing goals will serve the purpose of defining the purpose of your app.

If you truly want to differentiate yourself, then focus on features that help customers solve their most frequent issues.

Dive into Research

There are two types of research that must be done prior to working on a project. We also need to consider what your competitors are doing and what you expect from your audience. This will assist you in choosing what new features and services your app should offer.

Think about your ideal user—what would make their experience smooth and stress-free?

Decide on Key Features

When selecting the features to offer in your insurance app, avoid complexity, but instead, prioritize areas such as easy sign-up, clear policy details, smooth claims submission, secure payment processing, and good customer service. Customers are satisfied and actively use a clear and easy-to-navigate app. As we discussed above, the features of an Insurance mobile app clearly depict the value of adding them and what can happen if you skip them.

Simplicity is key. The simpler it is – the more your customers will like it.

Choose the Right Tech

Will your app be for iOS, Android, or both? Or would a cross-platform app make more sense? Such decisions have implications for how much time and money you will require.

Native applications are stand-alone apps developed for a specific platform and are ideal when you do not want to redesign the app for another platform.

Design an App That’s Easy to Use

Your insurance app design should be aimed at not outcompeting other apps, but rather to be intuitive and natural for a user to interact with. The interface should be free from complexity, easy to understand, and have good graphics. Imagine using that interface with basic experience and no knowledge about technology.

It’s important that you should always make your designs accessible to a small group of users to find where your design needs improvement.

Build the App

Work with experienced developers who can bring your vision to life. Focus on both the front end (what users see) and the back end (how everything works behind the scenes). Remember to always take security into consideration even while working on insurance data.

Test It Thoroughly

Before launching, test the app on different devices and scenarios. Look for bugs and frequent crashes and ask yourself how easy or difficult the software was to use.

This step is crucial. A minor glitch can anger the users and lead to critical consequences for your company.

Launch Your App

Finally, once everything is set and caught with keen attention, it is time to go live. Make your app available on stores such as Google Play and the App Store. Pair this with a marketing campaign to let your audience know it’s available.

Listen to Feedback

After the launch, simply ask the users of the insurance app design interface for their opinion. They are also important in letting you know how to improve your work.

Encourage reviews. It is beneficial to your business and establishes credibility for fresh users.

Keep It Updated

Customers and technology know a lot of constant evolution. Updates are relevant, efficient and provide security to your app hence they should be done on regular basis whenever the need arises.

Check Out Our Detailed App Development Process to Better Understand How We Works at SPEC INDIA.

The estimates of how much it will cost to build an insurance mobile app depends on the following considerations. The cost of a basic app might go somewhere between $15,000 to $30,000 and the cost might range further up to $50,000 to $200,000 for a full-fledged advanced app that might include features like — Artificial Intelligence claims processing as well as third-party integrations.

It also depends on whether you are planning to build the application for iOS or Android, or for both, and where exactly the development team is located (using offshore can be cheaper). One should also consider constantly updating the app to avoid getting neglected and having part of the app or even the whole app not function well. This is especially important in insurance app development, where regular updates ensure that the app remains functional and secure for users.

Creating an insurance app is by no means an easy task. There are several challenges along the way, but do not worry. We will be with you every step of the way. Let’s look at some common challenges and how SPEC INDIA tackles them:

Customers’ information is sensitive data that cannot be compromised due to security is of the essence when it’s involved. Also, there are some standards that you have to obey, such as GDPR, HIPAA, and PCI DSS.

How We Solve It: We ensure that every aspect of the app is tightly secured with encryption and secure APIs. We also perform periodic checks on everything to make sure they are compliant with all the rules.

Most insurance companies are still working under older systems, and getting these systems integrated with the modern app can pose a challenge.

How We Solve It: Like a bridge between the previous systems and the new app, we create solutions that help you transition. That simplifies the process and allows all systems to go smoothly without changing your current layout.

The insurance app must be easy to use for all users, and at the same time, must be effective in its functions. And that is not always possible to do.

How We Solve It: We state our priorities on simplicity and usability of the designs. Furthermore, we integrate accessibility options so no matter how tech-savvy a user of your app is, he or she will still be able to use it.

Insurance policies become so complex when you are dealing with health, car, life, property, or travel insurance in one application.

How We Solve It: All the management is sorted out with proper interface and dashboards where policy management is not at all a headache.

What happens when tens, hundreds, or thousands of people converge to use your app at the same time? It needs to be processed without a hitch.

How We Solve It: We incorporate cloud-based tools and ensure your app is designed to accommodate the traffic, especially during rush hours like claim submission.

It has become evident that the insurance business is currently on its biggest tech adoption spree yet. On one hand, we have smart call center technology reducing the rim of customer engagement then on the other hand Blockchain guarantees secure online transactions. With mobile application trends like Internet of Things (IoT) or connected devices, predictive analysis or telematics are helping in underwriting and offering solutions to clients. Keeping one step ahead of the competition requires the organization to integrate these technologies for efficiency and customer satisfaction.

At SPEC INDIA we know all about insurance mobile app development. Whether it is related to the security of your app or making it easier to navigate, or ensuring that it can accommodate as many users as possible, you can trust that your business and customers will enjoy the best experience.

If you’re ready to turn these challenges into opportunities, we’re here to help!

Insurance mobile apps are quickly gaining popularity as they serve insurance customers and providers in an efficient way. Such are the apps that will automate the flow of business, enhance customer relations, and control expenses. Even though designing an insurance mobile app has limitations like data security and compliance, the benefits overshadow the difficulties.

By staying ahead of insurance technology trends, insurers can continue to meet the ever-evolving needs of their customers, ensuring a more efficient and secure insurance experience for all. Whether you’re a customer looking for convenience or an insurer aiming to innovate, insurance mobile app development is the key to the future of insurance.

SPEC INDIA, as your single stop IT partner has been successfully implementing a bouquet of diverse solutions and services all over the globe, proving its mettle as an ISO 9001:2015 certified IT solutions organization. With efficient project management practices, international standards to comply, flexible engagement models and superior infrastructure, SPEC INDIA is a customer’s delight. Our skilled technical resources are apt at putting thoughts in a perspective by offering value-added reads for all.

“SPEC House”, Parth Complex, Near Swastik Cross Roads, Navarangpura, Ahmedabad 380009, INDIA.

“SPEC Partner”, 350 Grove Street, Bridgewater, NJ 08807, United States.

This website uses cookies to ensure you get the best experience on our website. Learn more